The BOI is Back: Small Business Owners File Your BOI Report by March 21, 2025 to Avoid Costly Fines!

The Beneficial Ownership Information (BOI) Report is back, and the clock is ticking! If you own an LLC or a corporation, you're likely required to file this report with FInCen. Failure to file could result in penalties of $500 per day - up to $10,000 - and even potential jail time.

What are Beneficial Ownership Information (BOI) Reports?

BOI reports, mandated by the Corporate Transparency Act, require businesses to disclose ownership details to the Financial Crimes Enforcement Network (FInCen). The goal? To prevent financial crimes like money laundering, fraud and illicit shell companies.

This is not a tax filing - it's a federal compliance requirement designed to enhance transparency in US business operations.

What are the Penalties for Failing to File BOI Reports?

Ignoring this requirement isn't an option:

*$500 per day in penalties (up to $10,000)

*Potential criminal charges, including jail time

*Government action against your business

With no more court injunctions delaying enforcement, all businesses must comply by the new deadline: March 21, 2025.

What Information Is Included in a

BOI Report?

Filing is straightforward but requires detailed ownership disclosures, including:

*Business name and Employer Identification Number (EIN)

*Personal information of all owners (25% or more ownership)

*Home addresses of owners and controlling individuals

*Government-issued ID (driver's license or passport)

Who has to be reported?

*Anyone who owns 25% or more of the company

*Anyone who has substantial control, such as LLC managers, corporate officers and trustees

Who is Required to File BOI Reports?

Most LLCs, corporations and similar entities in the US must file unless they qualify for an exemption. Sole proprietors (without an LLC or corporation) do not have to file.

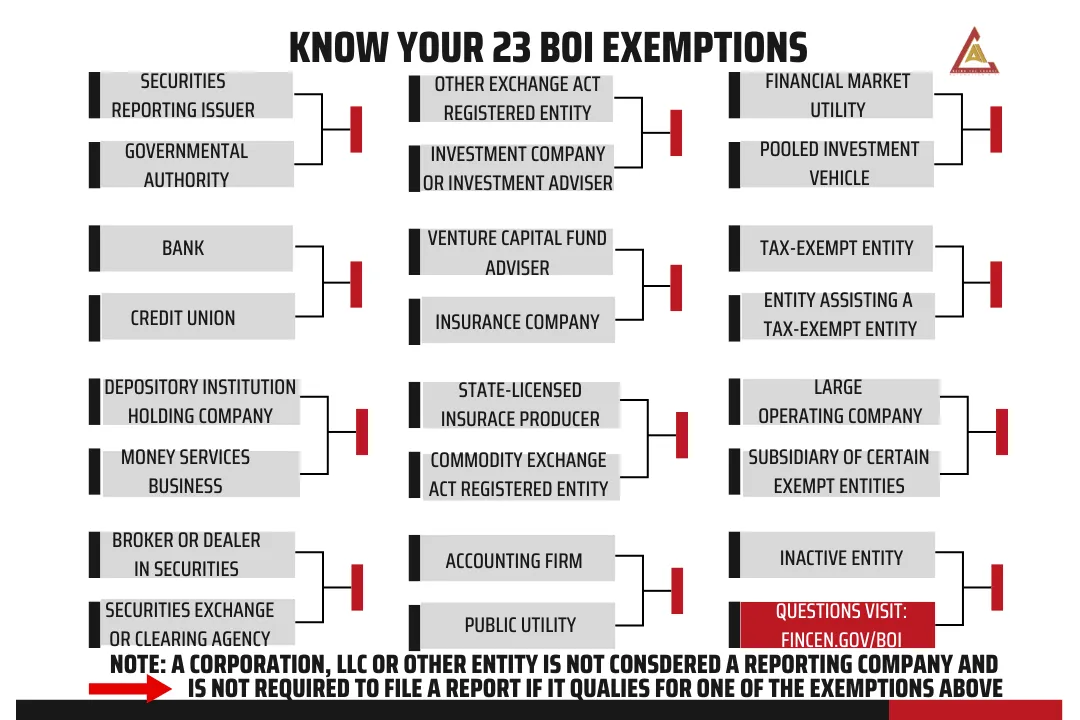

There are 23 exemption categories, including:

*Banks, credit unions, insurance companies

*Large operating companies (25+ employees and $5M+ in revenue)

*Publicly traded companies and certain nonprofit organizations

The Deadline for Filing Your BOI Report

*If your business existed before January 1, 2024, your original deadline was December 31, 2024 - but that deadline was removed.

*New deadline: March 21, 2025.

*For businesses formed in 2024: You have 90 days from your formation date to file.

*For business formed in 2025: You have 30 days from your formation date to file.

Waiting for the Supreme Court Case to overturn BOI reporting?

That's a gamble.

There is no legal injunction stopping enforcement - failure to file will result in fines.

What About Businesses Created in 2024?

If your business was formed in 2024, you must file within 90 days of formation. If you created a business in 2025, you have only 30 days.

Missed your deadline? March 21, 2025, is your last chance to comply before penalties kick in.

How to File a BOI Report with FinCen

Filing your BOI Report is free and can be done online through FinCEN. Here's how:

Gather required information (business details, ownership structure, ID documents)

Go to FinCEN's online portal FinCen.gov/boi

Submit your BOI report electronically

Professional service with Being the Change, LLC can assist with compliance to ensure accuracy and avoid penalties.

The Bottom Line

Ignoring this requirement could cost you $500 per day in fines.

If you own an LLC, S-Corporation, Corporation, or similar business entity, you must file a BOI Report by March 21, 2025. Now is the time to take action, get compliant and protect your business!

Testimonials

Toi Bankhead

Amazing customer service. Highly recommended. Thank you for always providing great customer service!

Anissa Green

I have been using this firm for many years. They are the most knowledgeable, efficient, and friendly professionals in the accounting field.

Terri McGee

Had an amazing time with these ladies. They were punctual, friendly, professional and gave a lot of intel with their respected fields. Definitely coming back and using their other services.

FAQs

Answers to Your Key Questions About the Beneficial Ownership Information (BOI) Report

Does my company have to report its beneficial owners?

Most likely, yes. If your company is a small corporation or LLC and had to file a document with your state’s secretary of state (or a similar office) to create or register the business, you are likely required to report. Certain exempt entities exist, but most small businesses must comply.

Who is considered a beneficial owner of my company?

A beneficial owner is any individual who:

✔️ Exercises substantial control over the company, OR

✔️ Owns or controls at least 25% of the company.

Does my company need to report its company applicants?

Only if your company was created or registered on or after January 1, 2024. A company applicant is:

1️⃣ The person who files the document that creates or registers the company.

2️⃣ The person who is primarily responsible for directing or controlling the filing.

What specific information does my company need to report?

Your company must report:

✅ Company Details:

• Legal name & any trade name (DBA)

• Business address

• Jurisdiction of formation or registration

• Taxpayer Identification Number (TIN) or Employer Identification Number (EIN)

✅ Beneficial Owner & Company Applicant Details (if applicable):

• Full legal name

• Date of birth

• Residential address

• ID number from a driver’s license, passport, or other approved document (plus an image of the document)

When and how should my company file its initial BOI report?

📅 Deadlines depend on when your company was created or registered:

• Existing companies (before January 1, 2024): File by January 1, 2025.

• Companies created/registered between January 1, 2024 – December 31, 2024: File within 90 days of receiving actual or public notice of your registration.

• Companies created/registered on or after January 1, 2025:

File within 30 days of receiving actual or public notice of your registration.

What if there are changes or errors in the reported information?

⏳ Companies have 30 days to file updates or corrections:

• For changes: The 30-day period starts when the change occurs.

• For errors: The 30-day period starts when you become aware of the inaccuracy.

🔗 For full details and filing instructions, visit: https://fincen.gov/boi